Investing in achr stock price can be a great way to build wealth over time. One stock that has gained attention recently is ACHR, which stands for Archer Aviation Inc. This company is focused on developing electric air mobility solutions. In this article, we will explore the ACHR stock price, what influences it, and what investors should consider when looking at this stock.

Introduction to ACHR Stock Price

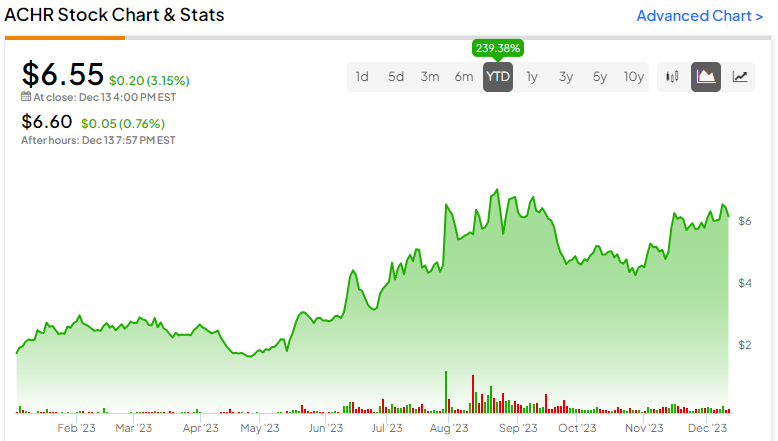

The ACHR stock price is an important factor for anyone interested in investing in Archer Aviation Inc. It represents the value of a share in the company. When investors buy stock, they are purchasing a piece of the company. If the company does well, the stock price may go up, allowing investors to sell their shares for a profit. On the other hand, if the company faces challenges, the stock price could go down.

Archer Aviation is working on creating electric vertical takeoff and landing (eVTOL) aircraft. This technology could revolutionize urban transportation by offering a faster, cleaner way to travel short distances. As the demand for greener transportation solutions increases, companies like Archer are poised for growth. However, the ACHR stock price can be influenced by various factors, including market trends, company news, and investor sentiment.

Understanding the factors that affect ACHR’s stock price is key to making informed investment decisions. Let’s take a closer look at what influences the stock price and what investors should keep in mind.

Factors Influencing ACHR Stock Price

Company Performance and News

One of the biggest influences on the ACHR stock price is the company’s performance. If Archer Aviation releases positive news, like successful test flights or partnerships with major airlines, the stock price may rise. Good performance in meetings and reports can build investor confidence and drive up the price.

Conversely, if the company faces setbacks, such as delays in aircraft development or safety concerns, the stock price could drop. Investors closely watch the company’s announcements to gauge its health and future prospects. Keeping up with news from Archer Aviation is essential for anyone interested in ACHR stock.

Market Trends and Industry Outlook

Another factor that affects the ACHR stock price is market trends. The stock market can be volatile, and external factors can influence stock prices across the board. For example, if the overall stock market is experiencing a downturn, ACHR may also see its stock price decline, even if the company’s performance remains strong.

The aviation industry is also changing rapidly. The move towards sustainable energy and green technologies has made electric air mobility a hot topic. If industry experts predict a positive future for eVTOL technology, it could boost ACHR’s stock price as investors become more optimistic about the company’s potential.

Economic Factors

Economic factors can also play a significant role in the ACHR stock price. Interest rates, inflation, and overall economic health can impact investor behavior. For instance, if the economy is growing, investors may be more willing to take risks and invest in emerging technologies like those developed by Archer Aviation.

Conversely, during economic downturns, investors may become more cautious. This can lead to lower stock prices for companies that are still in the early stages of development, such as Archer. Understanding the broader economic environment is crucial for anyone looking to invest in ACHR stock.

Investor Sentiment

Finally, investor sentiment can greatly impact the ACHR stock price. This refers to how investors feel about the stock market or a particular company. If many investors believe that Archer Aviation has a bright future, demand for ACHR stock will rise, pushing the price up. Social media and news outlets can amplify this sentiment, causing rapid price changes.

On the other hand, negative sentiment can lead to panic selling, where investors quickly sell their shares, causing the price to drop. Monitoring investor sentiment can provide valuable insights for making investment decisions regarding ACHR stock.

How to Invest in ACHR Stock

Research and Analysis

Before investing in ACHR stock, it is essential to conduct thorough research. This includes understanding the company’s business model, its competitors, and the potential for growth in the electric aviation industry. Reviewing Archer Aviation’s financial statements and reports can provide insights into its performance.

Using online resources and financial news sites can help investors gather information about the stock. Many financial analysts offer insights and predictions that can help potential investors make informed choices.

Creating a Balanced Portfolio

Investing in a single stock can be risky. It is usually better to create a balanced portfolio that includes a mix of different types of investments. This way, if one investment does not perform well, others may help balance the loss. Including stocks from various industries can reduce overall risk and increase the chances of making a profit.

Using a Brokerage Account

To buy ACHR stock, investors will need a brokerage account. Many online brokerage platforms offer easy access to buy and sell stocks. Setting up an account is typically straightforward and can often be done in just a few minutes. Once the account is created, investors can start purchasing stocks, including ACHR.

Monitoring Your Investment

After investing in ACHR stock, it is essential to monitor the investment regularly. Keeping track of the stock price and any news related to Archer Aviation can help investors make timely decisions. If the stock price rises significantly, investors may consider selling for a profit. Conversely, if the stock price drops, investors might choose to hold or sell, depending on their investment strategy.

Conclusion: Future of ACHR Stock Price

The ACHR stock price represents the value of Archer Aviation and reflects the company’s potential in the electric air mobility market. As Archer continues to develop its eVTOL technology, investors are watching closely to see how the stock price will evolve. Understanding the various factors that influence the stock price can help investors make informed decisions.

The future of ACHR stock will depend on many elements, including company performance, market trends, and investor sentiment. By staying informed and conducting research, investors can navigate the exciting yet unpredictable world of stock investing.

As the electric aviation industry continues to grow, Archer Aviation may present a valuable opportunity for investors. However, like any investment, there are risks involved. It is crucial to evaluate these risks and consider how ACHR stock fits into a broader investment strategy.

FAQs

Q: What is ACHR stock?

A: ACHR stock represents shares of Archer Aviation Inc., a company focused on electric air mobility solutions.

Q: How can I buy ACHR stock?

A: You can buy ACHR stock through an online brokerage account.

Q: What affects the ACHR stock price?

A: The ACHR stock price is influenced by company performance, market trends, economic factors, and investor sentiment.

Q: Is ACHR a good investment?

A: Whether ACHR is a good investment depends on your financial goals and risk tolerance. It’s essential to do thorough research.

Q: Where can I find information on the current ACHR stock price?

A: You can find the current ACHR stock price on financial news websites, brokerage platforms, and stock market apps.